Smallsats: Commercial Shift Spurs Growing Ecosystem

There was a time when thousands of smallsats weren't deployed into orbit. The industry structure change caused by smallsats creates other opportunities.

I feel as if I should note I seem bullish on smallsats because I am. There are a lot of aspects about them that I like, chief among them being their approachability. When smallsat manufacturers get down to the nitty-gritty parts of building a satellite bus, it allows customers to focus on the payload. And even then, the satellite manufacturers offer payloads as well. There’s plenty of room for testing innovative payload technologies or first-mover business plans.

That said, smallsats are a part of the space business and should be viewed as another tool in a large toolset, not the key to some hyped-up “transformation.”

Smallsat missions have morphed during the last ten or so years. In 2012, the missions tended to be conducted by universities or government organizations. The smallsats (using Bryce’s definition=satellites with a mass of 600 kilograms (kg) or less) generally were education, technical demonstration, and research platforms—too small for serious missions, too low for money-making opportunities, and too limited by the technology used at the time.

A Billion Here, A Billion There...

At the time, fielding a space system--any space system--would have been prohibitively expensive, requiring years to deploy, perhaps optimistically, ten satellites. An Earth observation satellite such as WorldView-2 cost around $400 million (less than its predecessors). It was launched in 2009. Government Earth observation satellites are usually more expensive, such as Landsat 8 (launched in 2013), costing nearly $1 billion.

Launch systems were also expensive, with large rockets costing north of $100 million and smaller ones costing ~$50 million. Not including the ground system, a single Earth observation satellite and its launch could set a company back nearly half a billion dollars. If everything went well, then that company could become profitable. Those nonsensically high costs, however, probably did much to sway potential entrepreneurs from entering the space industry.

Those costs are still around, and governments still tend to pay them. Legacy space communications companies also tend to pay those high costs. But others do not and manage to get constellations of satellites in orbit instead of a single bespoke one. While that may say something about government intelligence, their continued willingness to pay large sums could be attributed to a system of slow adoption. The changes pushing smallsat usage have occurred in the space industry in a relatively short period.

Those industry and market structure changes have much to do with making the industry affordable and attractive to entrepreneurs scared away ten years ago. Within those ten years, smallsats were increasingly used for commercial missions. Money can be made in the smallsat world—just not as much money (for now) as the incumbents are used to. As well, smallsats are compromises of compromises. Changes in the technology used are making them useful, but there’s only so much they can do. Nevertheless, there appear to be more uses despite their limitations. Evidence for that assumption is the increased use of smallsats for commercial missions during the last decade.

A (Short) History of Growth

The rapid rise in using small satellites (smallsats) for commercial missions has driven space industry changes that entrepreneurs can leverage. As a result, smallsat-based systems cost less, are fielded rapidly, and become operational in less time than it takes for some companies to manufacture a single satellite, such as WorldView-2. Those characteristics have proven attractive to businesses. But they also drive secondary effects throughout the space industry, attracting more businesses.

Smallsat operations and services have grown in the space industry. As noted earlier, smallsats were once the tools for conducting university and government experimental or technology demonstration missions. However, since 2012, most initially shifted to commercial Earth observation/remote sensing (EO/RS) missions. Additionally, since 2019, most smallsat deployments have shifted towards commercial low Earth orbit (LEO) broadband communications missions.

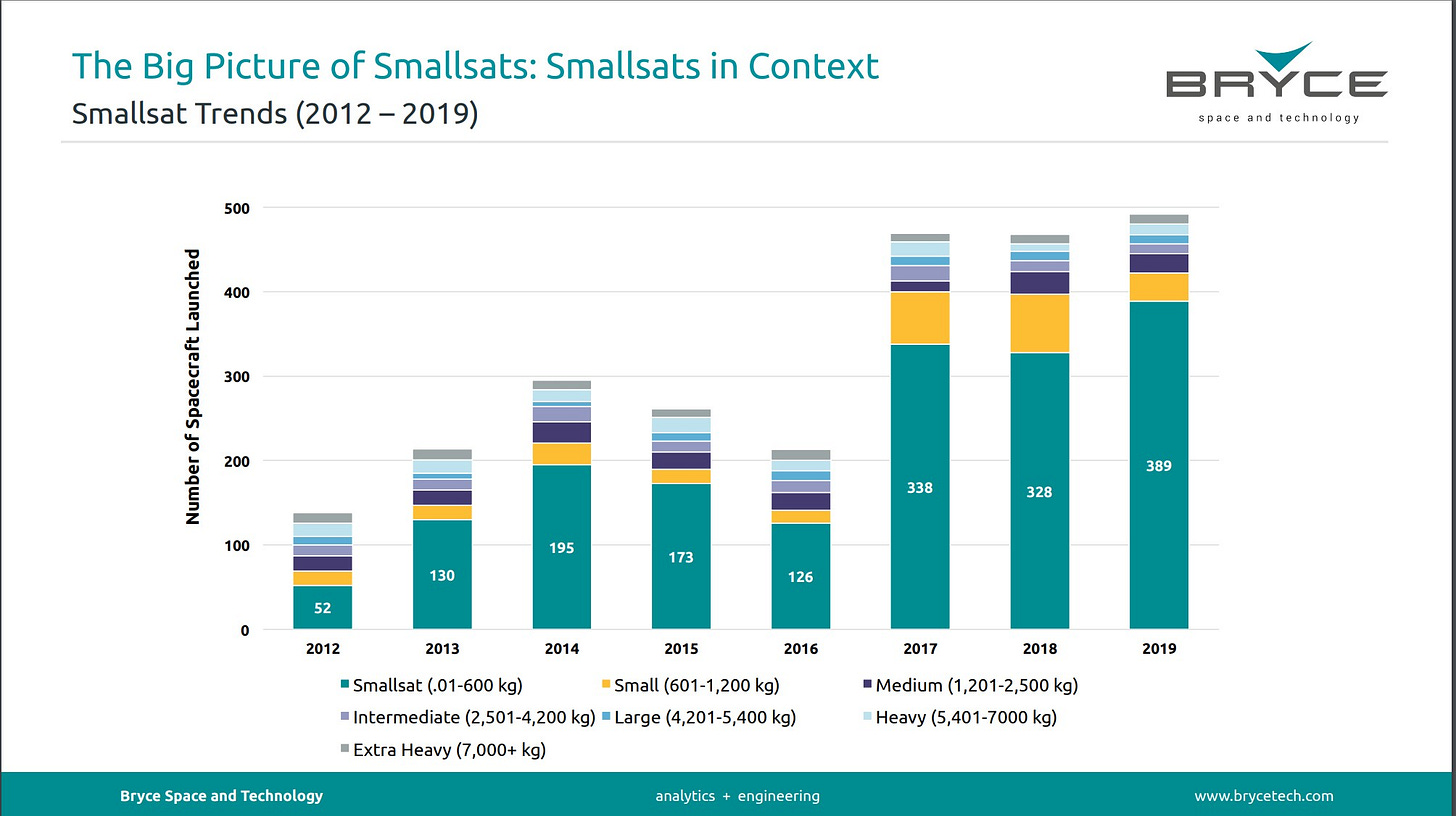

Smallsat deployment growth, in number and share, has increased significantly since 2012. In 2012, smallsats had a share of 40% of all satellites deployed that year. Commercial businesses operated 6% (3) of those 52 smallsats. The number of deployed smallsats has increased since those tentative smaller deployments in 2012.

Source: Bryce Space and Technology, 2020.

By 2022, the number of deployed smallsats had increased to an estimated 2,130 of a total of ~2,350 satellites. Nearly 2,100 of those smallsats (about 99%) were deployed for commercial missions. While that is a lot of satellites, nearly 80% of those 2,100 smallsats were Starlink satellites. Still, that leaves over 410 smallsats deployed in orbit during 2022 for commercial missions, which is a significant increase. That increase in operational orbiting smallsats during those 11 years required growing support services, which businesses can leverage.

The Ecosystem

Satellite manufacturers, launch providers, and ground networks started offering services in response to smallsat operator requirements and business plans. All those services represent industry and market structure changes. According to management and entrepreneurship consultant Peter Drucker, industry and market structure changes require businesses to act quickly before the competition catches on. Some appear to be doing just that.

Manufacturers

Smallsat-dedicated manufacturers are one of the major changes in the satellite manufacturing sector. Companies such as Blue Canyon Technologies, Berlin Space Technologies (BST)/Azista, NanoAvionics, and Terran Orbital offer relatively inexpensive satellite bus and payload integration services. Their bus design life for a satellite in LEO ranges from five to seven years. Other companies known for providing LEO broadband communications services, such as Airbus/OneWeb and Starlink, also offer satellite buses to satellite operators. All appear to manufacture satellite buses quickly, with a company such as Airbus/OneWeb boasting the ability to manufacture two satellites per day.

Launch Providers

Launch providers dedicated to providing services to smallsat operators have also increased, although some use existing launch vehicles for smallsat launch services. Access to this diversified capability gives businesses a choice that balances launch costs with launch flexibility to maintain an aggressive satellite deployment schedule. Below is a sample of rockets dedicated to smallsats (with the F9 Rideshare numbers thrown in).

However, increasing dedicated smallsat launch options doesn’t necessarily equate to lower launch costs. For example, the table below shows that a dedicated smallsat launch is still expensive (more expensive than even an Ariane 5 or Atlas V) on a cost-per-kilogram level.

The Indian Space Research Organization (ISRO), for example, consistently provided rideshare services to smallsat operators during the last 11 years using its Polar Satellite Launch Vehicle (PSLV), setting a record deployment of over one hundred smallsats in 2017. However, others like Arianespace, Rocket Lab, and Virgin Orbit introduced dedicated smallsat launch vehicles that could serve a business’s commercial small satellite deployment requirements.

The table contains other information that businesses should consider before selecting their satellite’s ride to space. Theoretically, more dedicated smallsat launch services should also mean more opportunities to use those services. That’s the launch frequency, and that row shows that more than half don’t even average more than one launch every four months. Although, those past five years include 2020, which did take a toll on some dedicated smallsat launchers.

Before 2020, the presence of dedicated smallsat launch services has driven an increase in overall dedicated smallsat launches from 2017 through 2019, despite their increased cost per kilogram. Those smallsat launch increases will likely continue, and businesses can take advantage of dedicated smallsat launch increases and the possible resulting lowered launch costs due to increased competition.

Source: Bryce Space and Technology, 2020.

A tantalizing option for any startup to consider, however, is SpaceX’s Smallsat Rideshare Program. The company entered the smallsat launch business with its program in mid-2019. It may be the increase in dedicated smallsat launches. The program offers the company’s Falcon 9 to deploy smallsats from various operators into orbit.

SpaceX's service cost is almost laughably low for smallsat operators compared to the dedicated smallsat launch services. However, the tradeoff for that low price is that multiple space operators must share the same rocket (the “share” in rideshare). This may mean accepting non-optimal orbits for some operators. SpaceX’s low launch cost could mean the difference for some startups between deploying a single satellite or deploying five. Five smallsats might be enough for a business to become operational and get cash.

Ground Segment

One of the biggest money-savers in this smallsat ecosystem is that businesses don’t have to build a dedicated ground network to communicate with their satellites. Some ground networks can cost billions, and while they still are costly to build, there are alternatives.

In 2012, commercial ground networks were provided by companies such as Kongsberg Satellite Services (KSAT) and Swedish Space Company (SSC). Those companies generally operate satellite communications terminals close to the Earth’s poles. However, a newer, less capital-intensive (for smallsat operators) ground communications service now caters to smallsat operators even as KSAT and SSC attempt to offer similar services: ground stations as a service (GSAAS).

GSAAS companies offer nearly everything a burgeoning smallsat operator requires: low up-front subscription costs, secure terrestrial networks, and comprehensive/global antenna networks for satellite data and telemetry communications. Amazon and Microsoft began offering GSAAS in the last three years, using their extensive server farms and communications backbones to compete against each other and the dedicated satellite ground networks offered by KSAT and SSC.

What’s beautiful for a smallsat operator using GSAAS is that a single satellite's subscription cost can be very low. It can anticipate cost increases based on GSAAS pricing and additional smallsats and plan accordingly. They also offer computing power, making online analytics more affordable.

Other products are also being offered to smallsat operators. For example, sensor and thruster manufacturers manufacture products with “good enough” or better performance while keeping payload and propulsion mass requirements low.

Low Costs and “Good Enough”

Using these technologies and services enables companies to deploy constellations of smallsats for an overall cost less than a single commercial communications satellite. While the smallsats themselves may not be as capable as the larger, more expensive satellites, the constellations of smallsats deployed so far appear to provide products and services that are “good enough.”

There are trade-offs, and the smallsat economy is not making revenues approaching those of regular space industry products and services. However, there are more opportunities because the costs are more manageable. So far, smallsat operators have embraced opportunities in the form of obvious missions: Earth observation and communications. Still, obvious missions have challenges, and the companies that have overcome them in their businesses are surviving the odds.

The projected low costs and rapid deployment schedules from the industry changes in the smallsat world allow for a quicker return on investment, making investors happy. But, of course, as with everything smallsat, the return on investment is minimal compared to satellites accomplishing similar missions ten years ago. The faster satellite manufacturing capabilities and (seeming) more smallsat launch opportunities also allow companies to deploy satellites in compressed timelines rapidly. They are deploying entire constellations within years of their founding—which is how long it takes some satellite manufacturers to build a single satellite.

Smallsats won’t replace those larger satellites. But they certainly can complement them. In some cases, they’ll be used in missions where a larger form factor makes no sense. Moreover, many technologies, services, and pricing are in place for a savvy entrepreneur to leverage in becoming a smallsat business.

Do the changes during the last ten years make becoming a smallsat business affordable and attractive enough? And do they outweigh the compromises? Some companies have made that calculus and seem to be succeeding.